Survey respondents again pointed to supply chain havoc and labor constraints as their key concerns.

FCH Sourcing Network reported its monthly Fastener Distributor Index (FDI) for the month of August on Tuesday, and the figures were a bit of a conundrum.

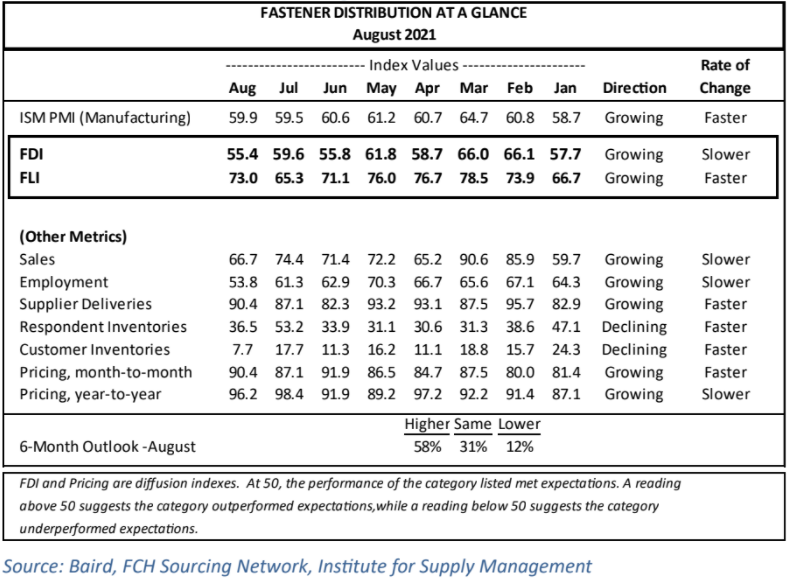

After a robust late winter, the FDI sunk 4.2 percentage points to a mark of 55.4 — its lowest reading since October 2020′s 54.5.

Meanwhile, the index’s Forward-Looking-Indicator (FLI) — an average of distributor respondents’ expectations for future fastener market conditions — jumped 7.7 points in August to a mark of 73.0 one month after falling to its lowest mark in nine months (November 2020, 63.2).

The latest figures suggest that fastener distributors, as a whole, have experienced a weaker summer after a strong first five months of the year, but foresee better market conditions in the not-too-distant future.

Any index reading above 50.0 indicates market expansion, which means the latest survey of North American fastener distributors indicates the fastener market expanded again in August, but at a slower rate than in July. The FDI has been in expansion territory each month since September 2020.

For context, the FDI bottomed out at 40.0 in April 2020 amid the worst of the pandemic’s business impacts on fastener suppliers. It returned to expansion territory (anything above 50.0) in September 2020 and has been in solid expansion territory since the start of this past Winter.

The increase in the FLI snapped four straight months of deceleration after peaking at 78.5 in March. Its considerable one-month increase comes despite continued concern supply chain and pricing issues. The FLI has been at least in the 60s each month beginning with September 2020.

“Commentary pointed to a strong supply-demand imbalance, labor shortages, accelerating pricing, and overseas supply chain difficulties.,” commented R.W. Baird analyst David J. Manthey, CFA, about the latest FDI readings. “Net, the FDI suggests August market conditions moderated some from July, although once again due more to labor/supply chain challenges than demand.”

Of the FDI’s factoring indices, respondent inventories saw the biggest month-to-month change, by far, with a 16.7-point decline from July to a mark of 36.5. That followed a 19.3-point jump from June to August, suggesting considerable volatility. Customer inventories fell 10.0 points to 7.7; Sales fell 7.7 points to 66.7; Employment fell 7.5 points to 53.8; and Year-to-Year pricing dipped 2.2 points to 96.2. As far as gains, Supplier Deliveries increased 3.3 points to 90.4; and Month-to-Month Pricing increased 3.3 points to 90.4.

Manthey noted that FDI survey commentary continued to focus on key themes of supply chain havoc and labor shortages.

Here’s a sample of anonymous distributor comments:

“Continued supply chain challenges due to port/rail congestion, raw material availability. Labor remains scarce.”

“Overseas supply chain delays continue to be a big problem.”

“In my 30+ years in the business I don’t think I have ever had such a difficult time meeting demand.”

“With delay in imported material and computer chips our sales are down by as much as 15% and doesn’t look like it is going to improve anytime soon.”

See the full August FDI table below:

Post time: Sep-17-2021